4 Ways to Save for Your Dream Vacation

Recently, I started thinking about where I’d like to go on my next big vacation. Not a few days away, a BIG trip. This type of vacation could require me to save a substantial amount of money. How will I pay for it?

Before deciding on a strategy, I have to consider a few things that will affect the amount of money I’ll need to save and the length of time I will have to save it:

1. WHEN do I want to take my trip?

2. WHERE do I want to go?

3. HOW will I get there (fly, drive, take a bus or train)?

4. WHERE will I stay (hotel/motel, hostel, resort, home rental, home trade)?

Although I haven’t figured out the answers to the 4 questions above yet, there’s no time like the present to start considering the options.

OPTION 1 – Pay with a credit card.

Pros –

– I have 2 credit cards that offer cash back when I use them to make purchases. This is a great way to save money on the trip by getting some of it back.

– If I need/want to, I can spread the expenses over several payments.

Cons –

– Unless I pay off my trip expenses within the month after charging them, interest will accrue on the remaining balance, which will cancel out the benefits of the cash back.

OPTION 2 – Pay with accrued airline miles (if you have them).

OPTION 3 – Pay with cash.

The best option for me, I think, is to save enough cash to pay off the trip expenses and use a debit card linked to the account I will be depositing my vacation funds into.

(Note: There are many, many ways to pay for trips and to save money on trip-related expenses, but for the purposes of this post, I am going to focus on saving cash.)

A few months ago, I came across an idea for a savings plan that made its way around Facebook. Its called “The 52 Week Savings Challenge.” Below is an explanation of the challenge along with several variations on it. I am going to try one of them; maybe one will work for you, too.

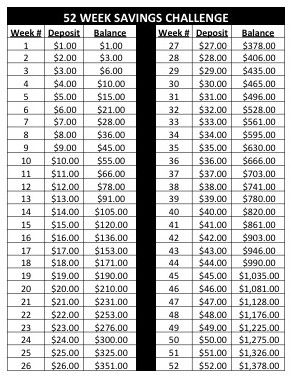

THE 52 WEEK SAVINGS CHALLENGE (STANDARD)

The premise of the challenge is that a person starts saving money, ideally at the beginning of a new year, and makes a deposit each week. The amount of the deposit corresponds with the week number. For example, week 1, you deposit $1; week 2, you deposit $2, and so on through week 52 (see the illustration below). If you follow the plan, the result is a savings account with $1,378 in it. A nice little chunk of change, I’d say! That could pay for a very nice vacation (or at least a good portion of it).

There are some people that say the 52 week challenge is unrealistic, as “life tends to get in the way.” Cars need unexpected repairs, your kids need clothes for school, the dishwasher breaks and has to be replaced, etc. Also, if you start the plan in January, the largest deposits would be due around the holidays, when money is already tight. So…they suggest doing the 52 Weeks Savings Challenge…but in reverse.

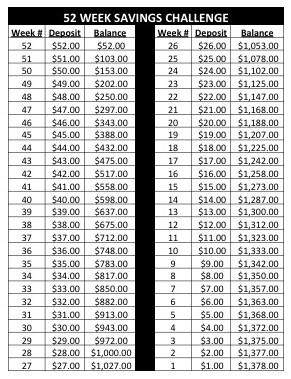

THE 52 WEEK SAVINGS CHALLENGE…IN REVERSE

So, how do you do the plan in reverse? Instead of starting at week 1, you start at week 52 and countdown backwards. Week 1 becomes Week 52, so the deposit that week is $52. Week 2 becomes Week 51, so the deposit is $51, and so on. Using the reverse method, the amount of your deposits decrease each week but the balance increases pretty quickly (see the illustration below). The logic behind this is that having to make a smaller deposit each consecutive week is easier than having to make a larger deposit. I have to admit, this makes a lot of sense.

- It’s a lot less daunting

- The higher balance keeps you motivated to stay on the savings plan

- Even if you don’t finish the entire 52 weeks, you have a substantial amount of money accrued

[irp posts=”692″ name=”Cut Vacation Costs…Take a Staycation Instead!”]

THE 52 WEEK SAVINGS CHALLENGE…WITH A TWIST

A third variation on the savings challenge offers a little more flexibility for saving. With this method, you deposit what you have available that week and check off the corresponding week and deposit amount. For example, if you have $13 to deposit, you check off the $13 deposit for Week 13. If you have $40 to deposit, you check off the $40 deposit for week 40. You repeat this until you make deposits for all 52 amounts and end up with $1,378. However, this method is not as stringent in terms of the amount you have to deposit each week. It would be best, though, if you tried to make deposits in the larger amounts when possible as those are usually harder to make.

And, last but not least…

THE 52 WEEK SAVINGS CHALLENGE…SIMPLIFIED

A fourth option for doing the savings challenge is very simple: You divide $1,378 by 52 weeks and make a deposit of $26.50 each week for 52 weeks. The result is the same: $1,378, but the deposit amount is not too high to stick with.

If you think about it, most of us spend $4 on coffee at Starbucks or $10-$15 eating lunch out when we’re at work. If you do BOTH, you have almost spent one week worth of deposits.

I’d love to hear your thoughts on these four savings options. If you have other creative ways to save money, I’d love to hear them too!

As always, wishing you awesome travels!

A Traveling Broad

![[Video] How to Travel for Less: Budget Travel Tips from Millennials](https://www.travelingbroad.com/wp-content/uploads/millennial-travel-header-e1541949876990.png)

Hey Amy, that is great advice! I’ve never heard of the 52 week challenge before this! I will have to start doing this too. One thing that I already do that really helps me put money away is pay myself first. When any money comes in, I put at least 10% of it away into a ‘financial freedom’ account. Paying yourself first instead of your bill(still pay your bills of course), lets the universe know that you consider yourself more important than bills-it’s an ‘energy’ thing. Can’t wait to hear more from you! Great posts so far!

Hi, Jane. Thanks for reading my post and commenting. I, too, have money taken out of my paycheck and “pay myself first.” I didn’t start doing this until later in my life, but its never too late to start. Its great to see the savings and 401(k) balances increasing – it keeps me motivated to continue saving. 🙂

These savings tips are simple enough to do. I think most people might want to take more aggressive savings steps and change the numbers to suit their goal. Let’s say I want to get up to the point where I’m saving 20% of my income. Then I need to figure out what 20% of my weekly earnings is and make that Week 52, then work backward from there. Example: I make $1,000 a week. Week 52 deposit is $200. Divide 52 into 200 and it’s roughly 4. So make the increments each week jump by $4. Week 1 = $4, Week 2 = $8, Week 10 = $40, and so on.

Yes, Tracey, I agree that many people will want to save more money than $1,378. However, the plan options offer ideas for starting to save, which is the ultimate goal. Thanks for the comment!